Mr. Elon Musk, please help us with bureaucracy at its worstA Decades-Long Dep. of Education Injustice

Hundreds of families crushed by millions in fraudulent loans from ONE school:

“Mosdos Chiddushei Harim Institutions" - OPE ID. 02350900, an Ultra-Hassidic Jewish Bible school, in Tel Aviv Israel

The DOE ignores the Higher Education Act of 1965—this injustice continues today.

By Zvi Twersky—a victim.

Advocates Who Tried to Help

Despite their dedicated efforts on my behalf, the DOE ignored all attempts at resolution:

Chris Pappas

—Congressman, NH

Advocates for my case diligently starting in 2022.

Letitia James

—NY Attorney General

Personally engaged with me in 2022.

Sholom Twersky

—Assistant DA Deputy Bureau Chief, Kings County, NY

As my Father's brother, uncle, he's been assisting in my case for years.

The White House

In 2022, received extensive documentation but failed to take any action, merely forwarding it back to the Department of Education.

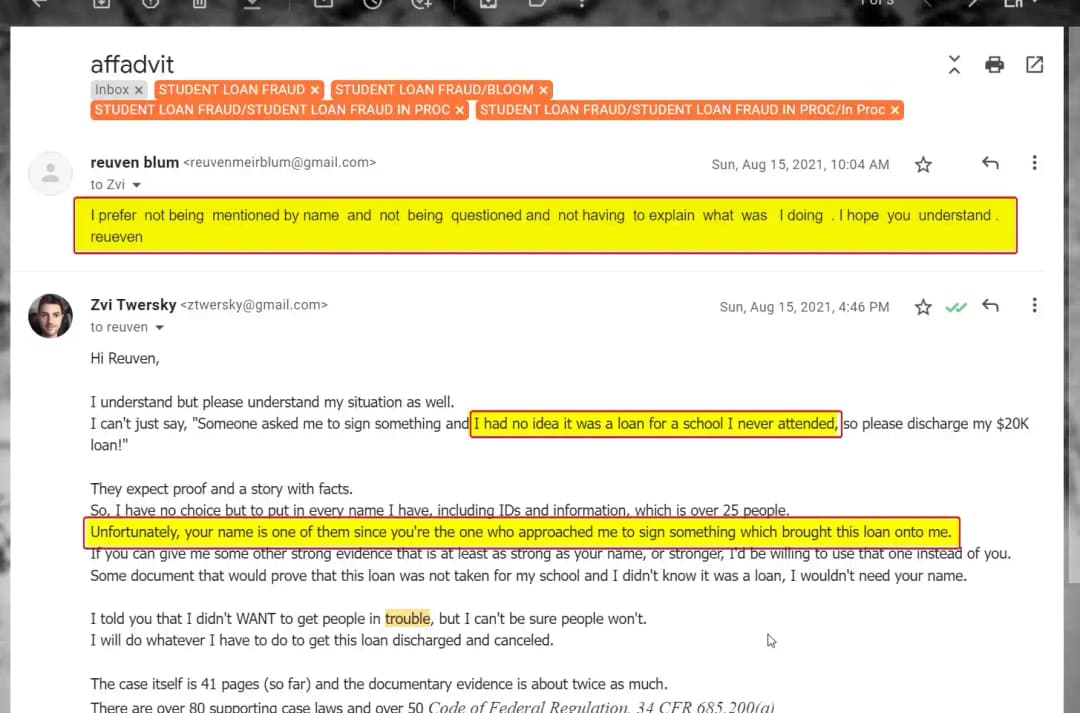

“I prefer not to be mentioned by name and not be questioned and not have to explain what was I doing. I hope you understand.”

—Rabbi Reuven Bloom

One of many emails from Rabbi Reuven Bloom, a student recruiter involved with the student loan fraud, following my notification of an appeal to the Department of Education for loan discharge.

I feel like I am David against Goliath in this situation.

I am facing a $22,430.69 charge for a student loan from a school I have never attended; I haven't set foot there even once. This is after the IRS seized my federal tax refund of $10,322.57 to cover this debt. Along with over 500 other students affected by this school's scandal, I have struggled for three decades with an incredulous Department of Education.

Preface

Over the years, I have provided the Department (ED) and the U.S. Department of Education Office of Inspector General (ED OIG) with hundreds of documents of supporting evidence to prove that I never attended that school. These included sworn, notarized affidavits from teachers, classmates, eyewitnesses, and employers. Still, the Department of Education has incredulously denied my claim.

Their denials are brief, irrelevant to my claim, and entirely ignore plain documented evidence. They mainly consist of “We require that you submit further documentary evidence”, without specifying what additional documents they require. It’s as if a robot churns out rejections, blind to facts.

In a 2021 letter, the DOE supported my claim by saying, “We contacted Mosdos Chiddushei Harim but were unsuccessful in obtaining information about your enrollment.” This admission, now mysteriously “missing” from their records, is fatal to their denials. The DOE’s claim that their 2021 admission is “missing” suggests concealment or incompetence, undermining their credibility.

For example, the Department’s denial On October 2021 stated the unrelated point that they have no records of any wrongdoing by this institution:

“This office has reviewed information from entities responsible for overseeing the school’s compliance with the ability to benefit regulations and has found no documentation of any violation of the ability to benefit during the time period of your enrollment.”

The courts have already constituted this denial as arbitrary, capricious, an abuse of discretion, and not otherwise in accordance with law and rule that requiring proof of other violations as a condition of discharge is contrary to law.

2016 UNITED STATES DISTRICT COURT (Price v. U.S. Dep't of Educ.):

The Department argues that it is proper to infer from the lack of systemic ATB violations at a school that no such violation occurred in a particular student’s case. While such an inference might be possible, it is fairly weak; one need not be a career criminal to be guilty of an individual crime. (Emphasis added.)

The Story

I’m Zvi Twersky, one of over 500 victims of this scandal. Like hundreds of other American Jewish Hassidic teens in Israel, I was deceived into signing blank loan applications by trusted religious leaders and community figures—men who I had been conditioned to obey without question. These loan applications were then fraudulently filled in with details of a Yeshiva in Tel Aviv, Israel, which we never attended, as if we were “full time” students there.

In the Hassidic world, we’re taught to obey rabbis without question—a trust Rabbi Nachum Kerenvasser, a respected leader in the Ger community, exploited in the 1990s. He orchestrated a massive fraud. This manipulation aligned with the Hassidic community’s cultural norms: rabbis and their affiliates are seen as unimpeachable authorities. To question them is unthinkable.

We were Ultra-Hassidic, meaning, we had no high school diploma, and were not given any ATB test approved by the DOE secretary.

Between the years 1992-1997, “Mosdos Chiddushei Harim Institutions”, an Ultra-Hassidic Jewish Bible school in Tel Aviv Israel, defrauded the Department of Education for hundreds of fraudulent student loans for students who never attended there.

I never attended Chiddushei Harim, the yeshiva tied to the loan. I haven't set foot there even once. Yet today, I’m saddled with $22,430.69 student loan debt, and a seized tax return of $10,322—which I am obligated to get back—as part of a discharge for a loan I never benefited from.

The scam targeting naive Hassidic teens, relied heavily on exploiting our trust and limited understanding of the secular world.

Rabbi Nachum Kerenvasser was the Rosh Yeshivah (dean) of the Yeshiva, and a distinguished member of the Hassidic “Ger” community, who passed away in 2017, aged 77. But his team are still alive and well, begging me not to mention their name’s which I of course have to the DOE.

In 1992, as a young U.S. citizen newly arrived in Israel with limited Hebrew skills, I was approached by Rabbi Reuven Bloom, a trusted figure from my Ger Hassidic community—just one day before my wedding.

The pitch was simple but devastatingly manipulative: “Sign this blank form, and we will fill out the details later, and take out a very small student loan, and it will be as if you graduated college. It will change your future.” We were told that this form was merely an administrative formality, that the funds were guaranteed to be paid off by the yeshiva, and that it was a pathway to financial and career success.

Little did we know that they would later fill in the details of a Yeshiva we never attended, make the loan amount for over $30K for each student, and keep all the money, leaving us in debt for years to come. They defrauded the DOE of millions.

This wasn’t just a vague assurance—it was a carefully crafted deception designed to appeal to young teens like us, who had no exposure to secular education or career opportunities in the Hassidic community.

For us, the idea of something being equivalent to a college degree was incredibly enticing. We didn’t have high school diplomas—ultra-Hassidic schools don’t provide them—and the prospect of a way to financial stability and employment was a dream we couldn’t resist. They dangled this false promise in front of us, knowing we’d trust their authority as rabbis without questioning the details. All they required was signing a blank loan application, our social security number, and they explained that all they would do is take a “very small” loan, and pay it back right away, which the Yeshiva would take care of, and that would make us “like collage students.”

I personally, was also super excited about getting married the next day and couldn’t focus on anything else. Little did I know this would haunt me for decades to come.

This lie about a college degree and future jobs wasn’t a minor detail—it was the heart of the fraud. It’s what convinced so many of us to sign those blank applications without hesitation. And yet, the Department of Education (DOE) has repeatedly denied my appeals over and over, refusing to acknowledge how deeply we were deceived by that specific promise.

Cover-Up: For a few years, Rabbi Kerenvasser made payments to hide the scheme. When he ran out of money in 2014, the lies began to unravel. Over 500 victims were harassed by collection agencies for years. Eventually, all loans defaulted, leaving them in despair.

For decades, the Department of Education (DOE) has ignored sworn statements, notarized affidavits, and overwhelming evidence of fraud, leaving hundreds of families—including mine—burdened by student loans for a Yeshiva (Ultra-Hassidic, Bible-Only school) we never attended. This bureaucratic failure has caused financial ruin, emotional distress, and shattered lives, all stemming from a scam that exploited the trust of naive Hassidic teens.

This case could be resolved in 15 minutes if the DOE called a few victims and asked: "Did you attend Chiddushei Harim?" Ninety-nine percent would say no, echoing my story. Instead, they’ve stonewalled us for years.

Clearly, the Department disregards the court's ruling on two key points: 1) The burden of proof must rest with them, and 2) They cannot rely solely on the promissory notes to justify their denial. Despite the extensive evidence I’ve provided, their denials consistently state, "Your request has been denied because the application says you attended." Here’s the relevant case law:

(The application need not be notarized but must be made by the borrower under penalty of perjury; (WILLIAM D. FORD FEDERAL DIRECT LOAN PROGRAM 34 CFR 685.214(c)))

Borrowers who submit a sworn application establishing their eligibility for a false certification discharge should be considered presumptively eligible for discharge. Once presumptive eligibility is established based on a borrower’s application, the burden should then shift to ED to disprove the borrower’s eligibility. Absent any credible evidence contradicting the borrower’s sworn statement or disputing the borrower’s credibility, ED should grant the discharge. ED should not consider electronic information provided by a school as credible evidence sufficient to overcome the presumption. ED should also not consider evidence or documents from a school engaged in the falsification or alteration of student records or documents submitted to ED, according to the findings of ED, any other government agency, an accreditor, or a court. (Salazar v. King 15-832-cv)

The abundance of documentary evidence that I have submitted thus far has been beyond “reasonable.” Even with the multitude of evidence, these were some of the robotic denials, while disregarding facts, laws, and no clarification:

July 19, 2021: “The Department requests that you submit further documentary evidence that corroborates your claim.”

August 19, 2021: “You state that you did not have a high school diploma. You must submit the enclosed “Ability to Benefit” application.”

October 12, 2021: “You state that this debt should be discharged because the school you attended, Yeshiva “Sefat Emes” falsely certified your ability to borrow. According to our records, The Department of Education does not service any debts obtained by you from Yeshiva “Sefat Emes.” Therefore, we are unable to process your application. The debt is for your attendance at Chiddushei Harim from 1992-1997.”

(That wasn't my claim at all.)

October 26, 2021: “You state that you did not have a high school diploma or GED prior to attending Chiddushei Harim. The information you provided is insufficient for the Department to determine the dischargeable of your loans. You must provide evidence that you did not have a high school diploma or GED.”

(I can’t prove a negative, but sent them a letter from the Israeli Department of Education (Misrad Hahinuch), stating that they have no record of me in their system.)

“You state that this debt should be discharged because the school you attended, Chiddushei Harim, falsely certified your ability to borrow. The Department reviewed your request for a loan discharge and determined that you do not qualify for a false certification discharge”. “We contacted Chiddushei Harim but were unsuccessful in obtaining information about your enrollment.”

(This is the letter that mysteriously vanished from their system.)

“We request that you submit the following information: Attendance letter – Student account – Academic Transcript – Any other evidence showing dates attended including withdrawal date you be alive may support your position.”

(A Yeshiva doesn’t have such records, especially since they don’t teach anything Academic – only bible.)

OCTOBER 2021: “This office has reviewed information from entities responsible for overseeing the school’s compliance with the ability to benefit regulations and has found no documentation of

NOVEMBER 2021: “We are unable to process your request because you did not provide documentation to support your claim.”

MARCH 17, 2022: “Unfortunately, you do not qualify for a discharge of your loan due to false certification.”

MARCH 22, 2022: “In order to aid our investigation, the Department requests you submit further documentary evidence that corroborates your claim.”

The Borrower Defense to Repayment Rules below, established by the U.S. Department of Education in 2016, directly apply to my case and mandate that ED officials evaluating an application for relief must also review ED records—a responsibility the DOE failed to fulfill! I challenge the DOE to produce any of the following: a single picture of me in Tel Aviv, one test or degree awarded to me by that school, a statement from any classmate, an attendance record showing I was present, or any shred of evidence placing me at that institution.

SUPPORTING CASE LAW:

Despite HEA’s discharge mandate, ED has denied discharges to many deserving borrowers by imposing evidentiary burdens that are almost impossible to meet and retroactively imposing new regulatory restrictions. These borrowers – many of whom have suffered from debt burdens for decades – deserve false certification discharges. […]

Most borrowers cannot provide this evidence. They need, but rarely have access to, attorneys who can track down the necessary evidence through Freedom of Information Act (FOIA) requests and legal research. (Salazar v. King 15-832-cv)

“Former students [...] often lack records from their schools (and rarely have school records of their own).” Even when borrowers are represented, school records can take months to arrive or are simply unavailable. In an effort to make the application process fair, the 2016 Rules required that ED official assigned to assess if an individual application was eligible for relief also consider ED records. Defrauded borrowers’ student loan debts also ruin their credit, which in turn limits their ability to rent or purchase a home. Worse, when federal student loans default, ED can extrajudicially garnish borrowers’ wages and seize their tax refunds.

More generally, requiring borrowers to prove that a school’s misrepresentation was the sole cause of their harm will exclude people in vulnerable situations, the very people predatory schools aggressively aim to recruit from relief. Few will be able to prove that their school was the sole cause of the hardship they experienced.

In addition to imposing heightened eligibility requirements on defrauded borrowers seeking loan relief, the 2019 Rules rescind the 2016 Rules’ limits on when schools could compel borrowers to forced arbitration. The 2019 Rules reverse course from ED’s prior position that predatory schools were using arbitration clauses to stop students, law enforcement, and oversight agencies from catching wind of their predatory practices.

These clauses cause many students immense harm. Arbitration prevents many borrowers from accessing justice at all; legal aid organizations often do not have the capacity to represent individually defrauded borrowers in arbitration proceedings, and arbitration clauses prevent wrongs from being addressed via class action or private litigation. Many predatory schools use arbitration clauses to insulate themselves from liability for wrongdoing and to prevent school accreditors, ED, and law enforcement agencies from discovering students’ complaints. And when students are prevented from using class actions to challenge and build an evidentiary record of predatory schools’ practices, those practices often stay hidden from the public for years. Indeed, the Supreme Court has repeatedly recognized that class actions are essential to provide redress for claims that are too time- and resource-intensive to assert individually. ED recognized in its 2016 Rules that “Abusive parties aggressively used waivers and arbitration agreements to thwart timely efforts by students to obtain relief from the abuse, and that the ability of the school[s] to continue that abuse unhindered by lawsuits from consumers [had] cost taxpayers millions of dollars in losses and [would] continue to do so.” (NY Legal Assistance Group v. Elisabeth DeVos 1:20-cv-01414)

The Federal Regulations, “Title 34, Subtitle B, Chapter VI, Part 685, Subpart B, § 685.216 Unpaid refund discharge” specifically say: “the borrower provides to the Secretary upon request other documentation reasonably available to the borrower that demonstrates that the borrower meets the qualifications for discharge under this section.”

The main problem is that the additional evidence they request is irrelevant or never existed, so it cannot be provided.

When they asked me to “prove” the impossible—that the school never gave me an ATB test—they ignored the fact that the institution is the one who needs to prove that I had an ATB test as ruled here:

SUPPORTING CASE LAW:

To qualify for federal educational financial assistance under either loan program, a student must attend an eligible institution and must have a high school diploma or recognized equivalent. If the student lacks a diploma, the institution must demonstrate the student has an ATB from the training that she would receive using the financial aid.

In Salazar v. King, for example, the Department of Education contended that a statute providing for loan discharge committed the decision to the Secretary’s discretion. 822 F.3d 61, 77 (2d Cir. 2016). The statutory provision, in relevant part, stated that if a borrower’s “eligibility to borrow under this part was falsely certified by the eligible institution . . . then the Secretary shall discharge the borrower’s liability.” (Salazar v. King 15-832-cv) See 34 C.F.R. § 668.32(e); U.S. Dep’t of Educ., GEN‐95‐42, Dear Colleague Letter, at 2 (Sept. 1995) (“DCL 95‐42ʺ) (summarizing changes in ATB requirements between 1986 and 1995).

If the Department of Education (ED) has received any documentation indicating that I have taken Ability-to-Benefit (ATB) tests, I formally request access to the results of these tests, as this claim is false. This form of fraud has also been acknowledged by the Supreme Court:

In 1987, the Department of Education (ED) began allowing schools to certify student eligibility by administering an approved ability-to-benefit (ATB) test. Hearings in 1990 before the Senate Permanent Subcommittee on Investigations (a subcommittee of the Committee on Government Affairs) documented the widespread falsification of ATB testing by for-profit schools. In addition, schools completed FAFSA applications for the students, indicating that the students had completed high school when in fact they had not. After hearing extensive evidence from the Office of Inspector General and others, the Senate Subcommittee placed the blame for the widespread fraud on ED. It concluded that “through gross mismanagement, ineptitude, and neglect in carrying out its regulatory and oversight functions, [ED] had all but abdicated its responsibility to the students it is supposed to service . . . .” The Subcommittee determined the “complete breakdown in effective regulation and oversight” had opened the door for “major fraud and abuse . . . , particularly at proprietary schools.” Based on the evidence gathered through the Subcommittee’s investigation, Congress enacted a broad mandate authorizing the ED to grant a loan discharge whenever a student’s eligibility to borrower was falsely certified by the institution. These practices continue to this day. (Salazar v. King 15-832-cv)

The subcommittee also found that “a virtually complete breakdown in effective regulation and oversight had opened the door for fraud, abuse, and other serious problems at every level.” S. Rep. 102‐58, at 11. In response to these findings of pervasive fraud in federal student loans and contentions of lack of adequate supervision by DOE, Congress passed a statute in 1992 directing that the Secretary of the United States DOE (“Secretary”) “shall discharge the borrower’s liability on the loan (including interest and collection fees) by repaying the amount owed on the loan” if the borrower received a federal student loan on or after January 1, 1986, and the “student’s eligibility to borrow under this part was falsely certified by the eligible institution.” Pub. L. No. 102‐325 § 437 (July 23, 1992), codified at 20 U.S.C. § 1087 (emphasis added).

SUPPORTING CASE LAW:

After struggling for three decades with repayment and a lawsuit filed by Legal Aid Foundation of Los Angeles, student loan borrower Sonia Escobedo finally received full forgiveness of the federal student loans that were fraudulently obtained by Career Institute in Long Beach, a for-profit school she never attended. (Escobedo v. Betsy DeVos, U.S. District Court, Central District. of Cal., Case No. CV 17-07586)

THE LOAN WAN’T USED FOR MY ATTENDANCE:

34 CFR 685.206(c) § 685.216 Unpaid refund discharge

(a)(1)Unpaid refunds in open school situations.

(i) In the case of a school that is open, the Secretary discharges a former or current borrower's (and any endorser's) obligation to repay that portion of a Direct Loan equal to the refund that should have been made by the school under applicable law and regulations, including this section, if –

(A) The borrower (or the student on whose behalf a parent borrowed) is not attending the school that owes the refund;

PRECEDENT - US COURT OF APPEALS:

Below are cases of students who were granted a discharge even though they attended the school in question. All the more so, I should be qualified for a discharge since I never applied or attended the school in my case.

Plaintiff Marilyn Mercado dropped out of school in junior high and enrolled in Wilfred Academy at age seventeen. She did not have a high school diploma or its equivalent and was not given an ATB test. Although she completed the program, she was unable to obtain a job as a hair cutter, the field that Wilfred purported to train her for, because she was not adequately trained to cut hair and not prepared to pass the cosmetology license test. Mercado ultimately defaulted on the debt. She is not able to obtain an extension of credit, and the IRS seized her federal income tax refund to pay the debt. She never received any communication from the DOE informing her of the availability of a false certification discharge. Mercado applied to the DOE for a loan discharge on April 9, 2014, and her discharge was granted on June 9, 2014. (Salazar v. King 15-832-cv)

Plaintiff Ana Bernardez alleges that she inquired about a Wilfred educational program in 1988, and she was told that the only requirement for enrollment was a Social Security number, and that it would cost only a few hundred dollars. Bernardez did not have a high school diploma or its equivalent and was not given an ATB test. She did not understand that she had taken out a loan until she tried to obtain a loan years later to cover the cost of furniture. The IRS seized her federal tax refunds approximately five times. She never received any communication from the DOE informing her of the availability of a false certification discharge. Bernandez applied to the DOE for a loan discharge on April 9, 2014, and her discharge was granted on October 14, 2014. (Salazar v. King 15-832-cv)

In 1987, plaintiff Jeannette Poole gave her personal information to a representative of the Wilfred Academy, who said he would use it to determine if she qualified for loans to cover the cost of the program. Poole did not have a high school diploma or its equivalent and was not given an ATB test. After receiving information from the Wilfred representative, she told the representative that she did not want to enroll in the program or take out a loan. (She was homeless and sleeping in an abandoned building at the time and did not want to take on debt). Even though she never attended any Wilfred program, Wilfred took out two loans in her name without her knowledge. Because these loans went into default, Poole was unable to enroll in a business training program at a community college over a decade later. Further, her credit was impaired so she was not able to receive credit for necessities such as repairing her living quarters damaged by a flood. Additionally, the IRS seized her federal tax refund despite her attempts to contest the loan. She never received any communication from the DOE informing her of the availability of a false certification discharge. Poole applied to the DOE for a loan discharge on April 9, 2014, and her discharge was granted on May 20, 2014. (Salazar v. King 15-832-cv)

Plaintiff Edna Villatoro enrolled in a Wilfred Academy in New Jersey. She did not have a high school diploma or its equivalent and was not given an ATB test. The Wilfred representative told Villatoro that the school offered GED classes, but a GED teacher was never provided. After completing the Wilfred program, Villatoro learned that to apply for a cosmetologist license in New Jersey she needed a high school diploma or its equivalent. She never obtained a license. The IRS seized her federal income tax refund. She never received any communication from the DOE informing her of the availability of a false certification discharge. Villatoro applied to the DOE for a loan discharge to the DOE on April 9, 2014, and her discharge was granted on June 17, 2014. (Salazar v. King 15-832-cv)

Plaintiff Lisa Bryant attended a Wilfred school in Houston, Texas in 1987. She did not have a high school diploma or its equivalent and was not given an ATB test. A Wilfred representative told Bryant that if she did not find a job within six months after graduation her loan money would be refunded. She attended the school for three months, until one day she arrived for class and was told by a security guard that the school was closed. She never received any correspondence about the closure. The IRS seized Byrant’s federal income tax refunds at least four times. She never received any communication from the DOE informing her of the availability of a false certification discharge. She has never been able to obtain a credit card or take out a loan to buy a car or a home because of the Wilfred debt. Bryant applied to the DOE for a loan discharge on May 28, 2014, and her discharge was granted on June 27, 2014. (Salazar v. King 15-832-cv)

Plaintiff Cherryline Stevens enrolled in a Wilfred school in Queens, New York in 1987. Stevens did not have a high school diploma or its equivalent and was not given an ATB test. Although she completed the program, the school never gave her an official diploma, which is necessary to get a cosmetologist license. Approximately eight years ago, Stevens started working at Queens Village Day Care and the DOE garnished her wages to pay her student debt. She has also had her federal tax refund seized at least three times. She never received any communication from the DOE informing her of the availability of a false certification discharge. At the time the lawsuit was filed Stevens was continuing to make monthly payments towards her student debt. Stevens applied to the DOE for a loan discharge on April 9, 2014, and her discharge was granted on June 18, 2014. (Salazar v. King 15-832-cv)

IDENTITY OF SOME PEOPLE INVOLVED IN THE FRAUD:

Main student recruiter:

Reuvain Bloom

Address: 2 Lev Simcha St. Beit Shemesh 9904101, Israel

Cell: (+972)-57-3181682

Phone: (+972)-2-5849171

Email: reuvenmeirblum@gmail.com

Rabbi Shvirtz:

Address: 38/23 Rashbi St 7765066 Ashdod, Israel

Phone: (+972)-2-5849171

Father Yaakov: (+972)-52-7114449

Email: reuvenmeirblum@gmail.com

“MOSDOS CHIDDUSHEI HARIM INSTITUTIONS”

ISREAL BRANCH:24 Nemirover St. Tel Aviv, 61130, Israel

Phone: (+972)-3-6476462, Fax: (+972)-3-6499081

Yeshiva Association number: 580037208

email: eliez69@zahav.net.il

1310-48 St, PO BOX: 190162, Brooklyn, N.Y. 11219.0003

Yeshiva Main Contacts:

Akerman (In charge of the money)

35/14 Harim Levin St. Ashdod 7765494 Israel

Cell: (+972)-57-3145148

Email: 850646@gmail.com

Akerman’s Secretaries:

Mrs. Shvirtz

Email: 57422@enativ.com

Phone: (+972)-8-8644422

Cell: (+972)-57-3181682

Phone: (+972)-2-5381682

Simcha

Cell: (+972)-57-3113637

Rabbi Noyshtat

Phone: (+972)-52-7627620

Authorized Signature School Official:

Solomon Sampson Adm.

Head of the Yeshiva: (passed away)

Rabbi Nachum Kerenveisser (He says that an older guy - Goldberg - takes care of the American money)

Address: 32 Baal Shemtov St, Bnei Brak, 51502

Israel Home Phone: (+972)-3-6185873

Cell: (+972)-57-3171987

CHIDDUSHEI HARIM TERMINATED IN FLORIDA

Here's another instance of 'where there’s smoke, there’s fire.' Given that 'Chiddushei Harim Institutions' appears on the Federal government's 'Terminated Institutions' list in Florida:

Chiddushei Harim Institutions

TERMINATED INSTITUTIONS

The following educational institutions, located in Region IV, have been terminated from the Federal Family Educational Loan Program by the United States Department of Education; (Id. FORIDA)

Lenders are instructed to hold all undistributed funds and to cease all organization activity for students attending these schools until instructed otherwise.

SCHOOLS TERMINATEDOPE ID# 02350900, MOSDOS CHIDDUSHEI HARIM INSTITUTIONS

- SUMMARY

- Mr. Elon, please help me achieve what I have requested in my sworn applications:

- • The Secretary promptly suspends any efforts to collect from me on any affected loan.

- • A loan discharge/cancellation of all outstanding federal student loans in my name (currently $22,430.69).

- • Upon discharge, a full refund of all payments made on these loans plus interest.

- • Upon discharge, a refund of the seized 2014 IRS tax return of $10,322.57 plus interest.

- • Upon discharge, the credit bureaus are notified of my discharge by the Department of Education.

Thank you, Elon!